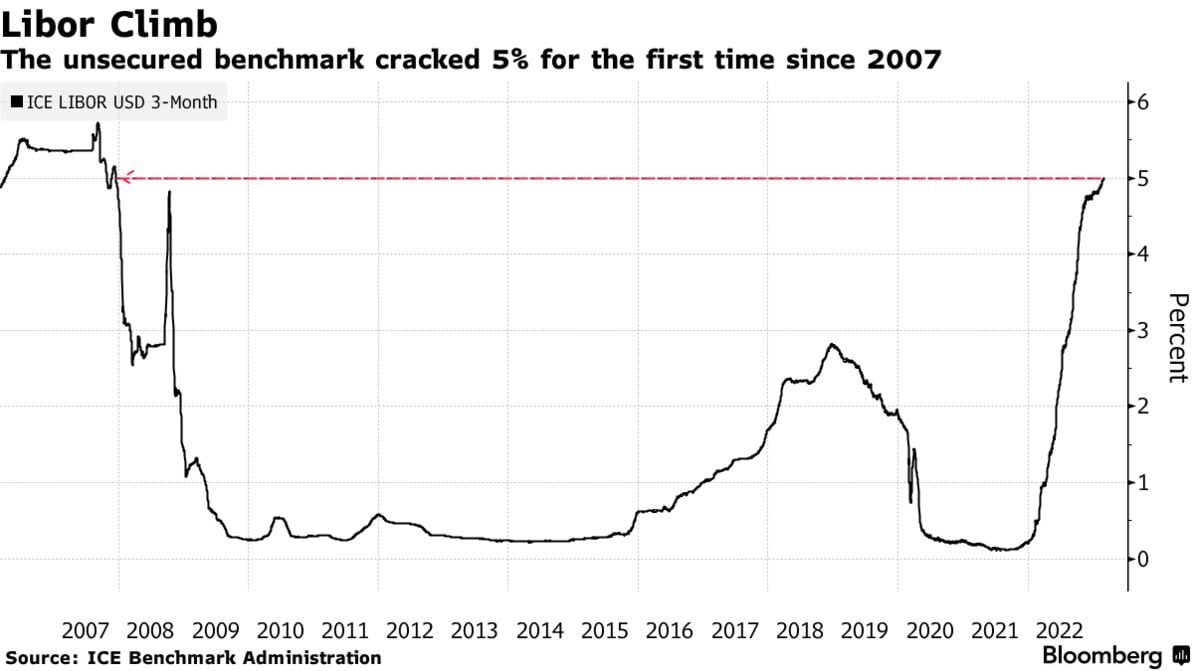

The three-month London interbank offered rate for dollars, a major global lending benchmark, surpassed 5% for the first time in more than 15 years on Monday.

The benchmark rate for lending between banks rose 2.4 basis points to 5.008%, the highest since December 2007. The spread of Libor over overnight index swaps — a barometer of funding pressure — widened to 3.2 basis points on Monday from 1.7 basis points the prior session.

Much of the recent surge in Libor, which is set to be phased out on June 30, has been driven by expectations for Federal Reserve policy tightening. Traders not only expect a higher terminal rate, but the central bank to remain at that level for a longer period than previously expected.

“The rise in Libor only makes sense as front-end rates continue to move higher on stronger data and expectations for more Fed rate hikes,” said TD Securities strategist Gennadiy Goldberg. “Notably, Libor-OIS remains quite tight, hinting at few funding pressures at the moment.”

While the Libor benchmark is moving in line with many other short-term rates, there are other elements that feed into the daily setting, including the backdrop for commercial paper transactions and broader credit conditions. But bank CP spreads relative to OIS have actually tightened due to light issuance and investors looking for places to invest cash.

Libor benchmarks for most currencies, and some for the dollar, came to an end at the close of 2021, but regulators decided to extend the life of some greenback-denominated reference rates for an additional 18 months until the middle of this year. A Fed-backed committee designated the Secured Overnight Financing Rate, known as SOFR, as the successor to US dollar-denominated Libor.

Link to Original Article: Libor Cracks 5% for First Time Since ‘07, Spurred by Fed Outlook