When treasury or accounting teams begin evaluating new software vendors, it is tempting to turn to a one size fits ‘some’ (or ‘most’ in the best of cases) approach. It’s a compromise that sounds good at the outset for valid reasons such as not needing to have to dedicate IT resources toward the integration of disparate systems. But fast forward down the track a year after implementation and the challenges of a one-size-fits-all solution may start to show as teams encounter an ever-expanding list of manual processes that have to be executed outside of the system. These workarounds and inefficiencies bring to light the compromises made in the name of adopting a more generalist single vendor. Fortunately for those finding themselves in this position, the tide is turning. Many financial and treasury software providers are proactively integrating with each other to offer the best of both worlds to clients, having done all of the heavy IT lift upfront. In other words, clients no longer need to choose between a specialist service that covers every part of their workflow and seamless IT setup.

Where the two worlds meet

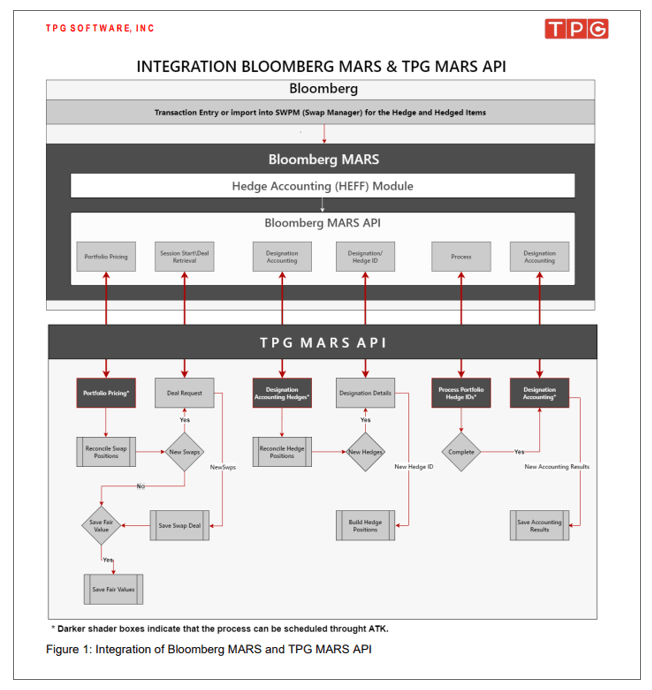

Accounting departments are one example of a team that stands to benefit a lot from this new approach from vendors. Ledger and portfolio accounting software vendors are often asked if they do valuations, hedge accounting and scenario analysis. They don’t. These activities are traditionally the wheelhouse of a risk system for the derivative calculations which, by their very nature, require vast amounts of market data. Similarly, vendors offering risk management systems are often asked if they can cross over into the ledger accounting world and populate balance sheet entries. They don’t. For example, bank treasuries in U.S. regional and community banks and credit unions asked their ledger accounting vendor TPG Software (TPG) how to streamline their derivatives, hedge accounting and derivative reporting workflow. Specifically, they needed to log all hedge accounting related journal entries such as OCI, interest accruals, periodic movement, credit-adjusted numbers, scenario numbers, daily valuations, plus the ability to schedule process reports. TPG and Bloomberg collaborated on a solution. By developing an integrated hedge accounting workflow across their systems, TPG’s banking clients who were also enabled for Bloomberg’s Hedge Accounting module, could now take advantage of new streamlined and time saving processes without any IT investment of their own.

“TPG has been a highly regarded sub ledger accounting solution for a long time. We have never ventured too far out of our lane with respect to analytics and calculating fair values. When we were introduced to Bloomberg MARS, and its capabilities, we quickly recognized that it was an excellent match of complimentary solutions.” – Cory Sokoloski, Sr. Vice President, TPG Software

The new utopia

As more software vendors collaborate with each other, a new world of opportunity is opening for bank treasuries. Not only are all their workflow requirements covered without the need for manual workarounds, the integration work is already done by the vendors themselves which frees up IT resources for other projects. Further, operational risks are also reduced as the responsibility for streamlined connectivity rests with the specialist vendors who already know each other. Thanks to a few vendors are leading the way, bank treasuries can demand this type of integration and service as one day soon it will become the norm.

Link to Original Article: How vendor integration enables the best of both worlds for treasury